ArtList, the Secondary Market of the Future?

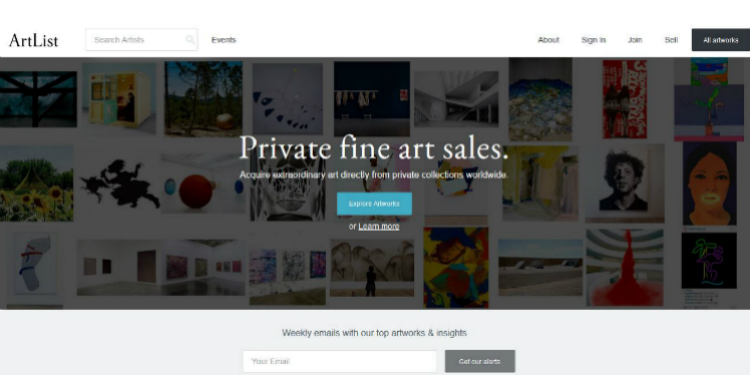

The Artlist website

Kenneth Schlenker is co-founder and CEO of the online platform ArtList, launched in New York in January 2015. The former Franco-American student of Sciences Po worked between France and the United States for companies like Google and HSBC before founding the network of collectors Gertrude in 2012, his first business in the art world. Art Media Agency had the opportunity to meet him and learn about the young ArtList platform that seeks to revolutionize the organization of the secondary market.

First off, how did you get into the art market?

I became interested in art as a young collector when I moved to New York. On this occasion, I started frequenting galleries, but the experience disappointed me. So I wanted to create something different. In 2012, I founded my first art company, Gertrude, an event company. It was rather intimate events, bringing together forty people around contemporary art, to learn, discuss and collect. In general, an expert presented the work of a contemporary artist in the artist to a collector or a gallery. It was the opportunity to meet the specialist, artist and other collectors in a warm atmosphere. We began to build a global network of enthusiasts from New York. Today we have over a hundred commissioners in the world: Los Angeles, San Francisco, London and some events in Paris.

A year and half later, you created ArtList. Can you tell us about the platform?

ArtList is a marketplace for the secondary market. It is a website where collectors can buy and sell works of art. We are a transparent company, and take a 10% commission that we share with the artist. We want to transform the art market by intervening in the secondary market, currently controlled by two large companies, Sotheby’s and Christie’s, doing the same business for 250 years. Today they control two thirds of the market and make the interaction on the secondary market – linking a buyer and a seller – complicated, very expensive and inequitable. With technology, we have the opportunity to reinvent the secondary market, to make it faster, more efficient and more equitable. ArtList aspires nothing more or less to realize this possibility by allowing collectors to meet and negotiate directly outside the house sales system, faster and more evenly: on each transaction, ArtList generates income for the artist.

Why the name?

First, ArtList is a reference to a second platform, which is private and confidential: Angel List. It brings together start-ups and investors. Secondly, we hope that the technology disappears in favor of art. The name ArtList is literally a list of works. We want our website to be transparent and accessible to those who do not want to spend time understanding how it works.

Is the public the same as Gertrude’s?

In part, yes. A third of our community are Gertrude Certified status collectors. These are people whose private collection includes artists with an important secondary market. We created ArtList because many of the collectors who came to us at Gertrude wanted us to help them buy or sell certain works on the secondary market. Before officially launching ArtList, we tested the process on a confidential level with a small portion of Gertrude collectors. This beta resulted in a success. So we wanted to make it our core business.

Do you also source collectors in another way, such as marketing for example?

The question is timely. We publicly launched ArtList January 21, 2015, with 300 listed works. After four months, our sales rose above a million dollars, which corresponds to the amount we raised from our investors – all independent. The first four months were spent on product optimization, collection of feedback and increasing our network of collectors by word-of-mouth. We did all this in contenting ourselves with a small presence on social networks – Instagram only. It was very limited. However, we are now entering a second phase with more marketing. For example, we’ve begun organizing a series of monthly dinners in New York.

What is the cost structure of ArtList?

We are primarily a technological product team. My seven colleagues and I are dedicated to building the best possible tool for buying and selling works of art. Half of our team is composed of engineers and designers who reflect constantly on improving our product, platform, trading online, management of transactions and transportation. The other half is focused on sales and customer service. Moreover, we do not manage inventory, therefore we have no inventory costs.

Can you explain the process of validation and sale of a work listed?

We want it as efficient as possible. It lasts half a day, the time for us to gather some important information about the work so that it is listed that evening. The next day someone can buy it. It is delivered two days later and the seller is paid three days after purchase. As for the validation process as such, it consists of four criteria: the artist must have a strong secondary market; the work must be unique or be an edition of less than 30 copies; it must be listed at market price from a range that is given to the seller; the seller must prove ownership of the work and trace its origin. For a work valued at over $100,000, we also require a certificate of authenticity. This process represents a certain investment for us. Our goal is to automate or outsource it to make it faster and more efficient. We’re working on it. However the advantage of our market place is its flexibility: if a work passes by our platform a second time, as happens occasionally, the cost is mu ch lower.

What portion of works are accepted in relation to the proposed number?

Approximately one fifth of works that we are offered we accept. To improve our product, we must be careful to select only those works that we are able to sell. Once we have developed our audience better, we can accept more works.

How do you see the evolution of sales of the secondary market?

The secondary market, online or not, is really beginning to transform. It evolves to include private sales which now represent 20% of total secondary market business. According to some estimates, this share will rise to 30% in 2016. Collectors are now more confident and ready to buy a work from a digital image. Just look at the latest edition of Frieze New York [14-17 May 2015]. Over 50% of the works were purchased before being exhibited at the fair. In the future, there will be a great online platform equivalent in importance to Sotheby’s or Christie’s, on which the collectors, dealers and artists can directly share the works they wish to buy or sell.

Do you think the market is large enough for small initiatives to multiply?

Unlike the major auction houses, we do not ask for exclusivity. The collector can remove the work at any time. We do not try to control a certain percentage of the market. Our platform can however cover a significant portion of the market. Collectors, dealers and artists can even use it as a flexible marketing tool and not exclusive. This gives us access to a large volume of works in the world. So I think this market is quite large indeed.

How do you see the future of ArtList?

Very good. We generate a real tension in the market between those who hate and those who love what we do. Then we offer a unique solution with great potential. We’re building the auction houses of tomorrow, without auction, without public appearance and inscribed within a network of collectors.