The Fine Art Invest Fund: The photography fund

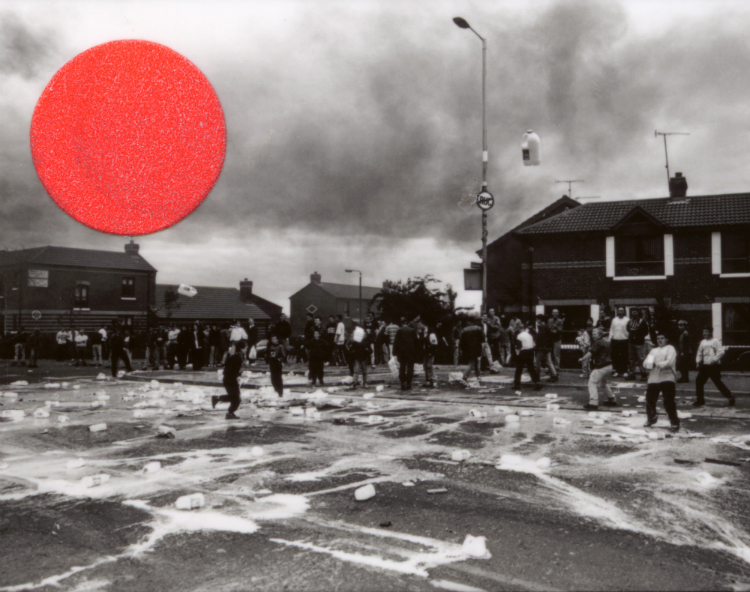

Political 1 sheet 19 3, People in Trouble Laughing Pushed to the Ground, Adam Broomberg & Oliver Chanarin, 2011, C-type print, 190cm x 150cm Image courtesy of The Artists and Lisson Gallery, London

In November 2011, when the bidding stopped at $4.3 million, Andrea Gursky’s photograph ‘Rhein II’ became the most expensive photograph ever sold at auction.

One year before the Gursky sale the Fine Art Invest Fund launched. The Fine Art Invest Fund is an art investment fund specialising in contemporary photography, with an emphasis on with works created after 1970. All of the top five selling photographs are contemporary ones.

“You can do a lot more with less money in the photography market, the prices are a lot lower” says Oliver Roehl, chief operating officer of the KMS Fine Art Group, the art adviser to the Fine Art Invest Fund: “You can really get lost within contemporary art, it’s a lot more difficult to create a contemporary fund. Modern photography is a young and undervalued market with a high potential for growth in value. Photography in itself is a young medium of less than 2 centuries, compared to paintings etc. But it making its way. Sotheby’s Auction in December broke the record for 175 Photographs sold for more than $20 million.

As well as strong demand for photography in art auctions and private sales there are also a growing number of art fairs focussed solely on photography. In 2014 Paris Photo attracted almost 60,000 visitors and Photo London will be running for the first time in May this year.

Working with the art advisory team KMS Fine Art Group, the photographs are chosen from three different categories; works by well-known established artists; works by less established artists that have a track record in the market; and emerging artists. Preferring to do business on the primary market, by buying directly from sellers or the artists, the fund saves on auction house commissions. The Art Advisory Team contains experts of the photography market like critics (Prof. Klaus Honnef) gallerists (Thomas Zander, publisher (recently deceased Walter Keller) curators (Marc Gloede) and collectors. The Fine Art Invest Fund was also used as one of two examples of an art fund by Deloitte in their latest art & finance report.

The fund often buy works directly from the artist, eliminating any issues of provenance, and also advises buyers. “We are also seeing an increase in people setting up their own collections, we offer consultancy services to clients and are seeing a lot more people interested in the photography market,” says Roehl. “There is a trend towards people investing in real assets and art is a safe and valuable real asset.”

Choosing photographs

Although the fund focuses on contemporary photographs it will occasionally break these rules. It owns what Roehl says is the only complete set of German photographer August Sander’s work in Europe of People of the 20th century, which he started in the early 20th century. It is one of the most influential bodies of work not only for the photography but also for the arts as well. This Series made the Dusseldorf Photography School of Bernd and Hilla Becher possible. Sander died in 1964 and specialised in portraits.

Sander’s portraits contrast with the very contemporary work of Deutsche Boerse Photography Prize 2013 winners Adam Broomberg and Oliver Chanarin who are now represented by the Lisson Gallery.

The fund also owns photographs by Oscar winning (Citizen Four) US artist Trevor Paglen focusing on surveillance and space. It bought these is 2013 and the value of them has risen quickly.

© Trevor Paglen courtesy Galerie Thomas Zander Köln Altman Siegel Gallery San Francisco Metro Pictures New York

Sharing performance

The Fine Art Invest Fund prides itself on its transparency. Roehl says transparency is the most important thing for investors and also improves the relationships with artists and gallerists. All legal documents and reports from PMG Funds Management, the fund manager based in Switzerland, can be viewed on the website, as well as images of the assets within the collection. The split of art and finance competence is what makes the fund different to other art funds. PMG Fund Management represents the Finance side and is the face of the company to the investor while KMS represents the art side.

The fund has had a +32.84% net performance rise since 2010 making the net asset value per share CHF132.84 ($138). In the 2014 fourth quarter results they announced the Net Asset Value of the entire fund is currently CHF16,371,717 ($17.1 million).

The fund is open ended so investors can withdraw their money on a quarterly basis.

The fund stores most of its works in a Swiss Freeport. They are Partner of Museums like e.g. The Photographers’ Gallery (London). It also lends to museums and has partner galleries in Zurich which exhibit some of the collection. Roehl says that they would one day like to build a museum to house the collection and to give more visibility to the collection to the public, which would probably be in Switzerland where the fund is based.

They also have plans to set up a new fund, which would still focus on photography but with no period limitation.