Art investment grows despite unpredictability of the market

Most art market people and most financial analysts respond negatively to the idea of contemporary art either as an investment or as an asset class. Contemporary art is best described as illiquid, fad-and-fashion driven, with opaque markets. All art has high transaction, storage and insurance costs. Art markets are essentially unhedgeable. Finally, there are always issues of authenticity.

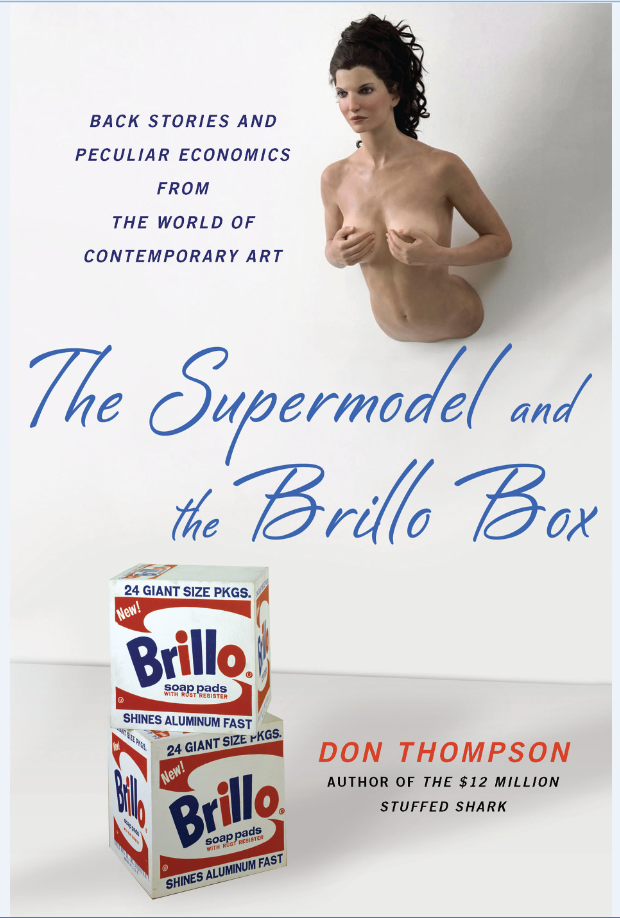

That is the view of Don Thompson, author of The Supermodel and the Brillo Box: Back Stories and Peculiar Economics from the World of Contemporary Art, published by Palgrave Macmillan this month.

Yet in spite of these concerns, he notes that the number of art investment funds has grown substantially in recent years. Deloitte estimated that at the end of 2012 there were 47 funds operating; most were in the US, UK and China, with several in each of Russia, Dubai, Brazil, India and South Korea. Many close within a few months of opening; a few have reported good results.

“One attraction is that art investment is more tax-efficient if done within a fund,” he told Private Art Investor. “The US and other countries tax capital gains on art at a higher rate than on other investments.

“An art fund operating out of New York but registered in an offshore domicile such as the Cayman Islands or Luxembourg, pays no capital gains taxes in that jurisdiction. The entire profit can be reinvested in further art purchases, or distributed as a dividend to shareholders to be taxed at a lower rate.”

He says that the most compelling argument for art investment may be the dramatic media stories detailing works that resold at auction for ten times their acquisition price.

“But those very few, hugely profitable transactions are the ones promoted to the media by auction houses,” he says. “Reading about art investment successes is like reading about the one-in-forty drill holes that find oil.

“No newspaper reports on the thirty-nine dry holes – or on contemporary art works that resell at 60% of their previous auction price. You never read about the four out of five contemporary works that Christie’s or Sotheby’s, or even Phillips or Bonhams reject for an evening auction because the artist is no longer in fashion.”

Thompson’s new book offers an engaging, frank and often bemused view of the top end of the art market. Not only is he aware of the difficulties that surround art investment; he has also gained insight into the tricky process by which an artist becomes successful.

Typically the artist connects with a mainstream dealer, has work taken to national art fairs and well received by collectors, then shown by foreign dealers and taken to international art fairs, written about in major art publications, then accepted for consignment by major contemporary auction houses.

“The ratio of artists who make the first ‘connection’ to having work offered at a major auction is something like 250:1,” he says.

If buying as an investment, he suggests that you get advice from a dealer or art advisor you are comfortable with, in the same way you are comfortable with any other investment advisor.

“If you are buying for enjoyment, choose art that touches your soul, that speaks to you and you know you want to live with and wake up in the morning with,” he adds.

When it comes to contemporary art, he cautions investors to be wary of assurances that a certain artist will go up in value.

“Choosing art on the basis of its staying power is predicting what other buyers will consider valuable in the future. A gallery owner or investment advisor who tells you, ‘This artist will sell for far more, five years from now,’ is acting as a judge in a cultural beauty contest. Caveat emptor!” he says.

Asked for his view on the current state of the global art market, Thompson notes that China is now well established as the second largest world market for contemporary art, with the UK third and France fourth – and of course, the USA first.

“A few artists in ‘emerging art’ countries like Iran, Russia and Brazil (and soon, Cuba) are beginning to attract global attention from collectors,” he says. “Worldwide sales of contemporary art appear to be growing 10-15% a year, with stable prices at the lower and middle levels of the market, and rapidly rising prices for high-end, museum quality art.”

When it comes to the contemporary art market, there is no shortage of supply; Thompson observes that if there are 50,000 working artists in New York City alone, and each produces two works of art each month, that adds up to 1.2 million new art works each year.

“The ‘shortage’ is of those iconic or museum quality works that are sought after by wealthy new contemporary art museums around the world, and by wealthy collectors,” he says. “Those are the works whose prices at auction are bid up, and attract front-page attention.”

Not surprisingly, Thompson is himself an art collector, but he buys from the heart, not with an eye on resale value.

“It is more accurate to say that art collects me,” he says. “Most of the works in my home have jumped out from their previous resting places when I first saw them, and demanded to be purchased. The central focus of the collection is very much on things that my wife and I both love and want to live with. Many works have come from one of the several countries in which we have lived or spent time. Most would be described as abstract impressionist or colour field.”